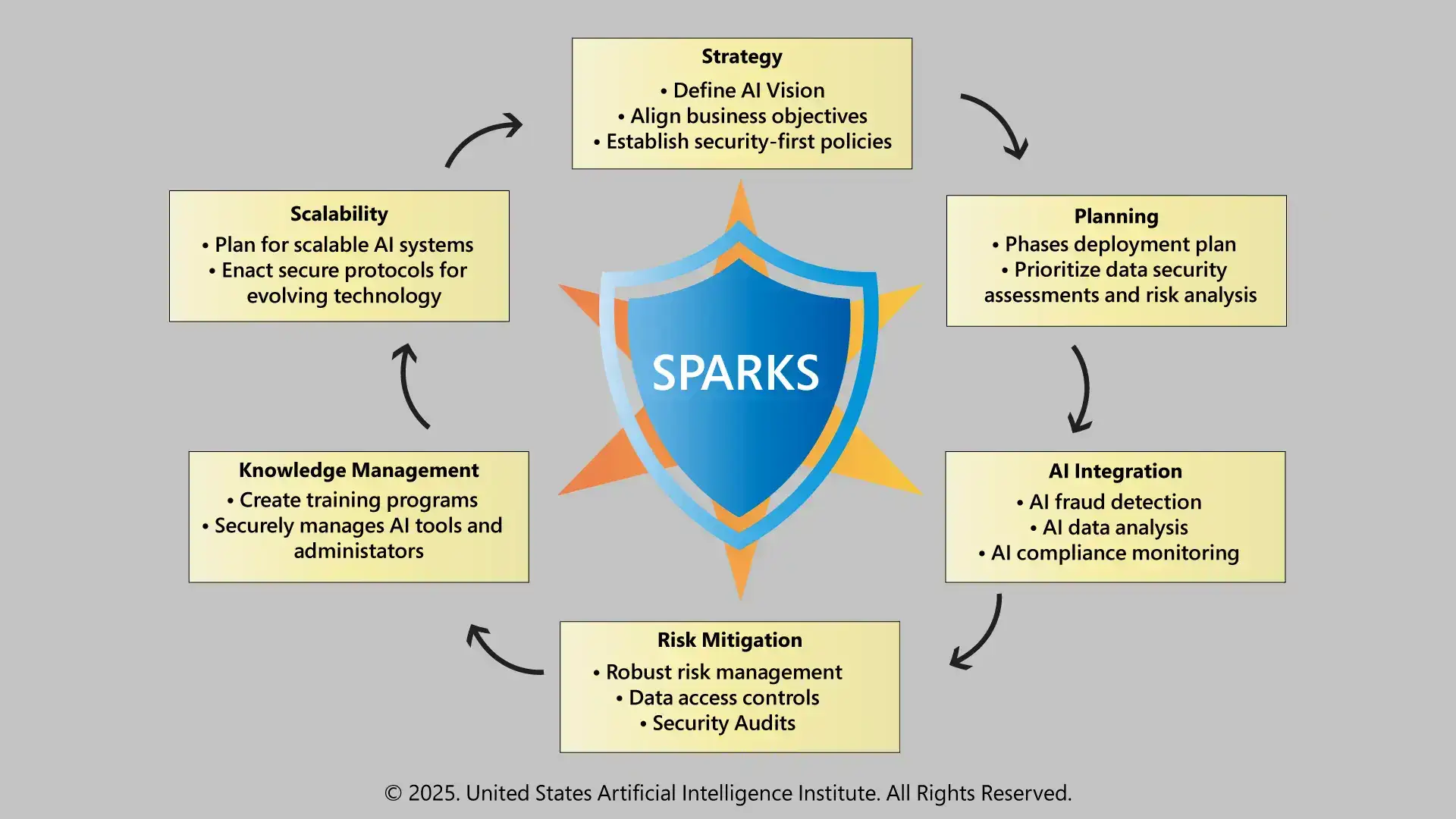

In the world of banking, adaptability and security have become the cornerstones of success. Financial institutions understand that to remain competitive, they must evolve. As the digital landscape shifts and customer expectations rise, our future depends on innovating trust, security, and efficiency. To meet that challenge, I have developed a strategic roadmap for responsible AI adoption, based upon a custom framework I call SPARKS.

The SPARKS Framework:

SPARKS is more than a catchy acronym; it is a cyclical, security-first framework developed specifically for guiding AI implementation in financial institutions.

This structured approach ensures AI deployment is aligned with our business goals while maintaining compliance with regulatory standards of the FFIEC and GLBA in the US, but it can also be used for other regulations around the world, such as GDPR (UK, EU), PIPEDA (Canada), APPs (Australia), APPI (Japan) and DPDP (India). SPARKS places security at the heart of every phase, from establishing access controls and governance to fostering transparency and continuous improvement.

Strategy:

At the heart of SPARKS is a clear and secure AI goal. Your institution’s mission statement for AI should be straightforward, like the following:

"AI implementation will improve upon our current expectations for customer experience, efficiency, and risk mitigation through secure and structured AI deployment."

AI adoption will strengthen our defenses against cyber threats, streamline back-office tasks, and deliver personalized financial services to our customers. With nefarious actors using AI to exploit vulnerabilities, we must respond oppositely and equally. AI will become our ally in fraud detection, operational optimization, and customer engagement. SMART (Specific, Measurable, Assignable, Realistic and Time-Related) objectives keep us focused on our goals such as; reducing false positives in fraud alerts by 30% to cutting mortgage underwriting time by 40%.

Security-first policies need to be embedded from the start. Every AI initiative must be built with governance, compliance and protection of Personally Identifiable Information (PII) and Personal Protected Information (PPI) in mind. This commitment helps build trust and ensures long-term resilience.

Planning:

The Planning phase translates ideas into execution. Over a 24-month timeline, map out your milestones. Here are some high-level ideas to get you started:

By prioritizing data security assessments early, you can prepare your infrastructure and people for secure deployment. These foundational efforts mitigate risks and ensure you meet evolving regulations while setting the stage for scalable AI use.

AI Integration:

In phase three, your organization will start with impactful applications in fraud detection. Our legacy rule-based systems can no longer keep up with the evolution of financial fraud. Machine learning models trained on historical transaction data will help

us identify new fraud patterns in real time. These models will be explainable and auditable using tools like SHAP (SHapley Additive exPlanations) values.

Beyond fraud detection, AI will support predictive analytics, customer behavior analysis, and time series forecasting. With natural language processing (NLP), we can analyze call center transcripts and feedback to measure sentiment and offer tailored services. All of this is powered by secure data handling practices, including encryption, monitoring of API endpoints, and strict version control.

Compliance monitoring tools can alert us to violations of policy, Banking Secrecy Act/ Anti-Money Laundering (BSA/AML) flags, and Know Your Customer (KYC) red flags, including politically exposed persons (PEPs) and sanctioned individuals. These tools will not only support ethical AI use but also meet audit and legal defense standards.

Risk Mitigation:

Be mindful to monitor for model drift, performance degradation, and regulatory shifts. Using SR 11-7 guidance from the Federal Reserve and like minded institutions/ agencies, we can ensure that all models are validated, governed, and reviewed by senior leadership.

Plan to deploy Role-Based Access Control (RBAC), Multifactor Authentication (MFA), and strong encryption for your AI solutions. Data masking and secure environment segregation will protect sensitive data from misuse. Periodic internal and third-party audits, guided by the National Institute of Standards and Technology AI Risk Management Framework (NIST AI RMF), will keep us accountable and ready for regulatory reviews.

Knowledge Management:

A successful AI transformation depends on associates as well. Budget for investment in robust training programs tailored to end users, data engineers, administrators, compliance staff, and executives. Topics should include AI ethics, tool-specific usage, data protection, and compliance requirements.

Administrators will be responsible for secure tool management such as; updating documentation, granting access, supporting end users, and staying current with regulatory and technical changes. Transparency, collaboration, and continuous learning will be of utmost importance in your AI culture.

Scalability:

The final phase of SPARKS is Scalability. Another necessity will be adopting modular, cloud-based AI architectures using platforms like Snowflake and Azure Machine Learning. These allow us to expand storage and resources as needed while controlling costs using tools like Azure Budgets.

To stay ahead of threats, integrate Zero-Trust Architecture (ZTA), enhanced by platforms like Zscaler and CrowdStrike Falcon. These ensure that access is verified and that all endpoints are monitored. This proactive approach creates the opportunity to remain agile and secure in the face of evolving technologies and risks.

Conclusion:

Get ready to ignite the next chapter of your organization with AI. Through the SPARKS framework, I have designed a transformation strategy that is structured, secure, and scalable. By embedding data governance, regulations, and continuous training into each phase, you will not just be adopting AI, you are building a sustainable, ethical, and competitive future for your institution and your customers. With SPARKS as your foundation you’re not just implementing tools, you’re lighting the way forward to achieve responsible innovation.

Follow us: